How To Record Ppp Loan Forgiveness

If the loan is recognized as debt. Since the PPP loan is potentially forgivable upon approval by the SBA which represents a contingency the receipt of funds should be initially recorded as a liability.

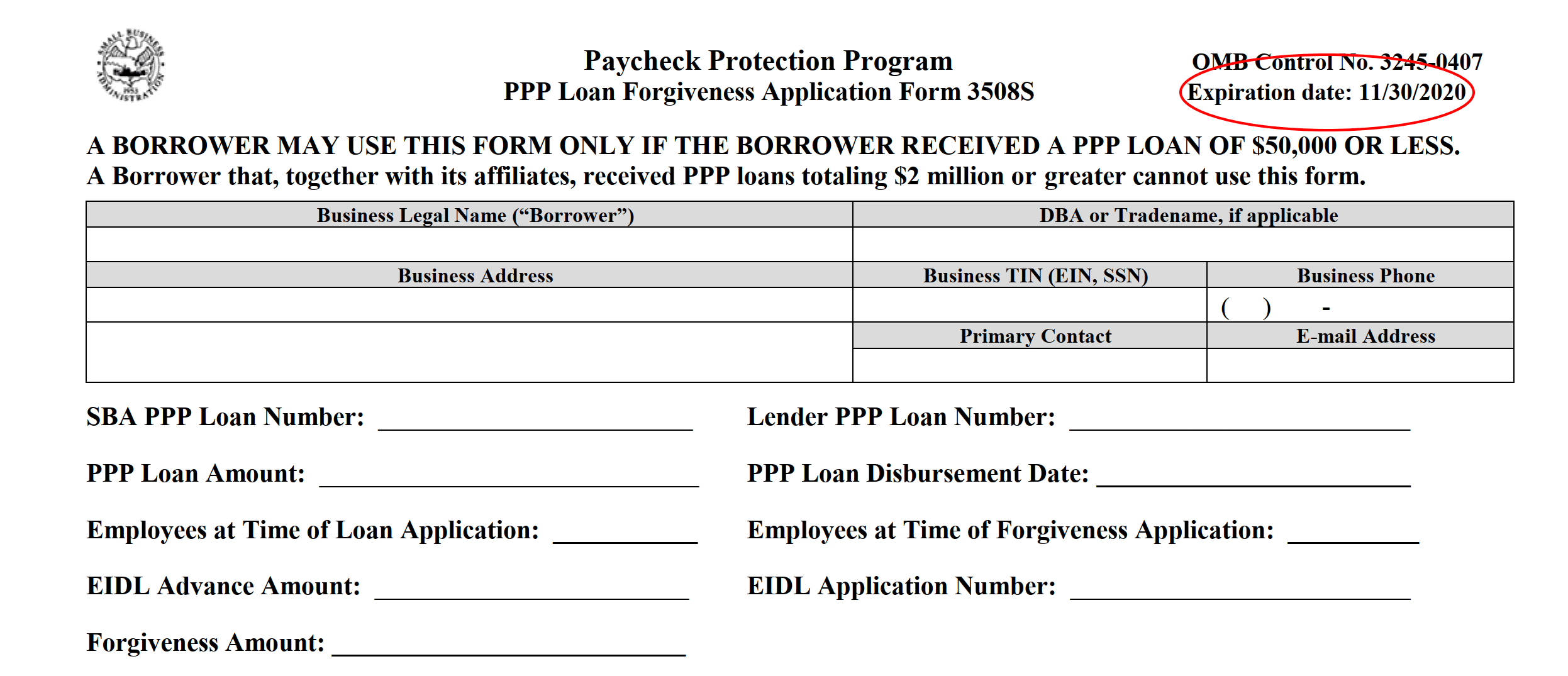

Know About Ppp Loan Forgiveness For Loans Of 50 000 Or Less

That is between you and the lender information on payroll you provide them and the six months grace youve been given to apply for forgiveness or make your first loan payment.

How to record ppp loan forgiveness. The forgiveness adjustments resulting from workforce and salary and wage reductions have been considered. If some or all of the loan is forgiven you would record income when legally released from the liability. The entry upon receipt of the PPP funds is.

First create an Other Income account in your chart of accounts called PPP Loan Forgiveness. The payrollother qualified expenses have been incurred. For PPP loans this condition is generally satisfied when all the loan forgiveness conditions have been met.

Head to Accounting and then Transactions. Now you need to reduce the Loan so DR PPP Loan and CR PPP Grant Forgiveness. Then go to your check register and write the check.

The amount which will be forgiven is known this amount can be adjusted accordingly. Companies should give consideration to accruing interest over this period as well. First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement.

The money from the loan would be recorded as a financial liability and begin accruing interest. To record accrued interest in your books for the PPP loan debit your Interest Expense account and credit your Accrued Interest Payable account which is a liability account. The cash inflow from the PPP loan is recorded as deferred income.

Make a new Other Income account called PPP Grant Forgiveness or XYZ Grant Forgiveness or name of other grant. A business entity can also analogize to the guidance in ASC Subtopic 958-605 or ASC Subtopic 450-30. End result PPP Loan is zero and Other Income shows as a credit on the TB.

Interest would be accrued and recorded based on the stated rate in the loan agreement. Retain as a liability until either the loan is partly or fully forgiven and the debtor has been legally released OR when loan is paid off. Income is recognized and the liability is reduced on a systematic basis as the eligible expenses are paid.

The caution here is that the forgiveness estimate and the actual results could differ upon final settlement especially where the grant period may cross year end. In the Account Name field enter something specific for example PPP loan forgiveness and click Save. The Book Tax reconciliation item isnt needed if the loan forgiveness isnt included in the book income.

Including loan forgiveness as an increase in shareholder basis. As of last week 33 million PPP loans worth a combined 2794 billion have been forgiven out of a total of 52 million loans issued last year. Forgiveness of PPP loan proceeds should be recorded as Other Income in QBO.

I would set it up at the least as a short term liability PPP Loan and then use. Complete documentation has been presented to the lender. An NFP should account for such PPP loans in accordance with ASC Subtopic 958-605 as a conditional contribution.

Your PPP loan is still listed on the books. At least 60 of the proceeds are spent on payroll costs. No data entry is needed on the McMs or M3-2M3S-2 screens since the PPP loan forgiveness is not taxable income.

The TQA also states that in situations in which the PPPs eligibility and loan forgiveness criteria are expected to be met. PPP loan forgiveness in not included as book income. Open the Account dropdown and select the PPP loan account.

Specifically the AICPA explained that there is no clear or uniform method to record forgiven PPP loans on a taxpayers return such as how and where they are. First Draw PPP Loan forgiveness terms. If the loan is forgiven wholly or partially the debt is reduced by that amount and a gain on extinguishment is recorded.

Once the contingency is resolved ie. The loan proceeds are spent on payroll costs and other eligible expenses. Many businesses record interest accruals during the month-end closing procedures and include interest incurred to.

Record initial cash inflow of PPP funds as a financial liability. Enter a description choose the date and enter the amount of the forgiveness in the Total amount field. Record the Forgiveness in Your Books Book the Receipt of the PPP Loan Funds When you receive the PPP funds record the deposit in your books to the newly created PPP Loan Payable.

Unfortunately as with so much of the PPP loan program. Create a new income account to track the funds heres how. The debt would remain on the books until it is either forgiven or paid off.

PPP funds 25000 and PPP Loan forgiveness -25000.

Cwg Insight Series Preparing For Ppp Loan Forgiveness Crown Wealth Group

Ppp Loan Forgiveness Application How To Track Ppp Loan Expenses Updated Template Included Youtube

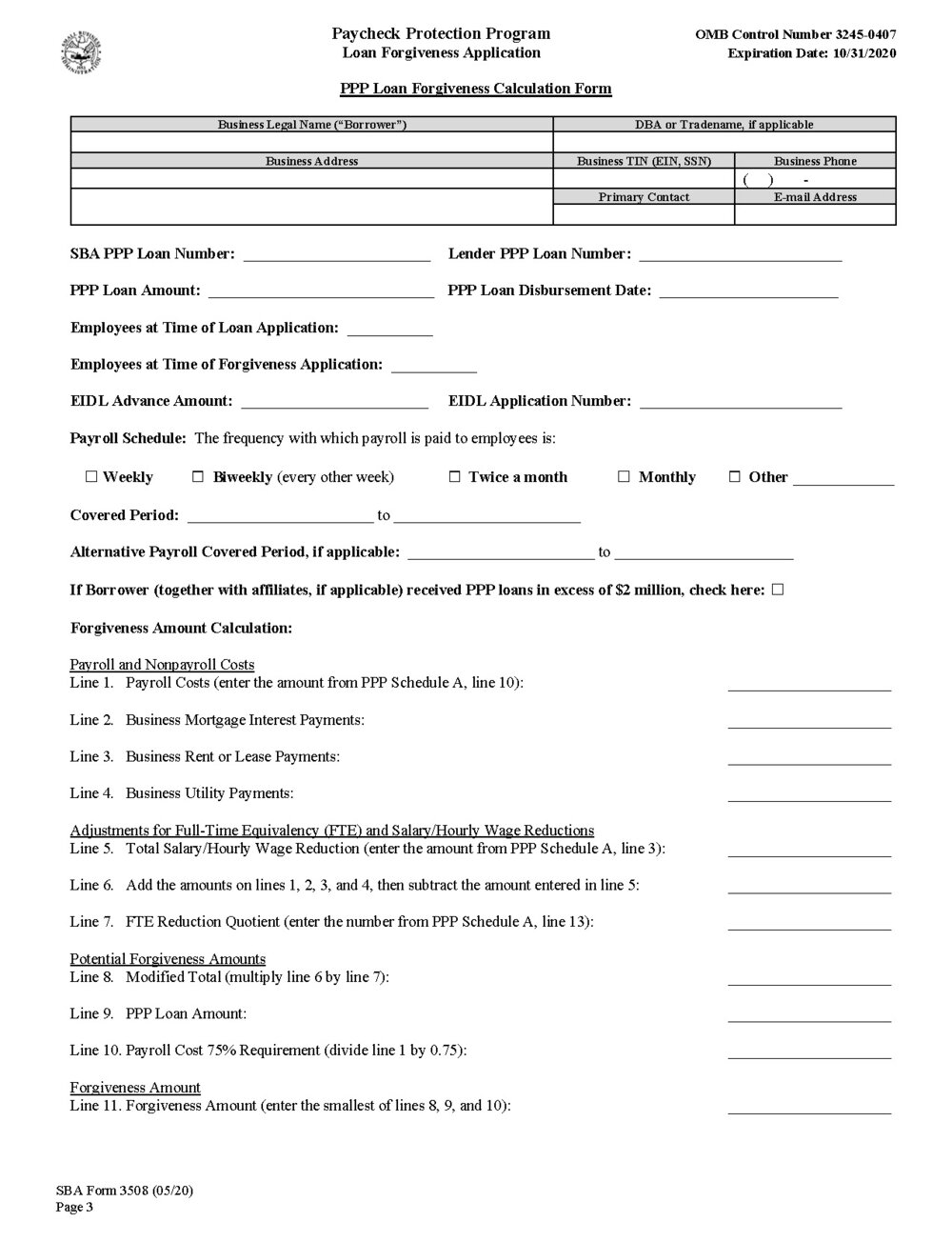

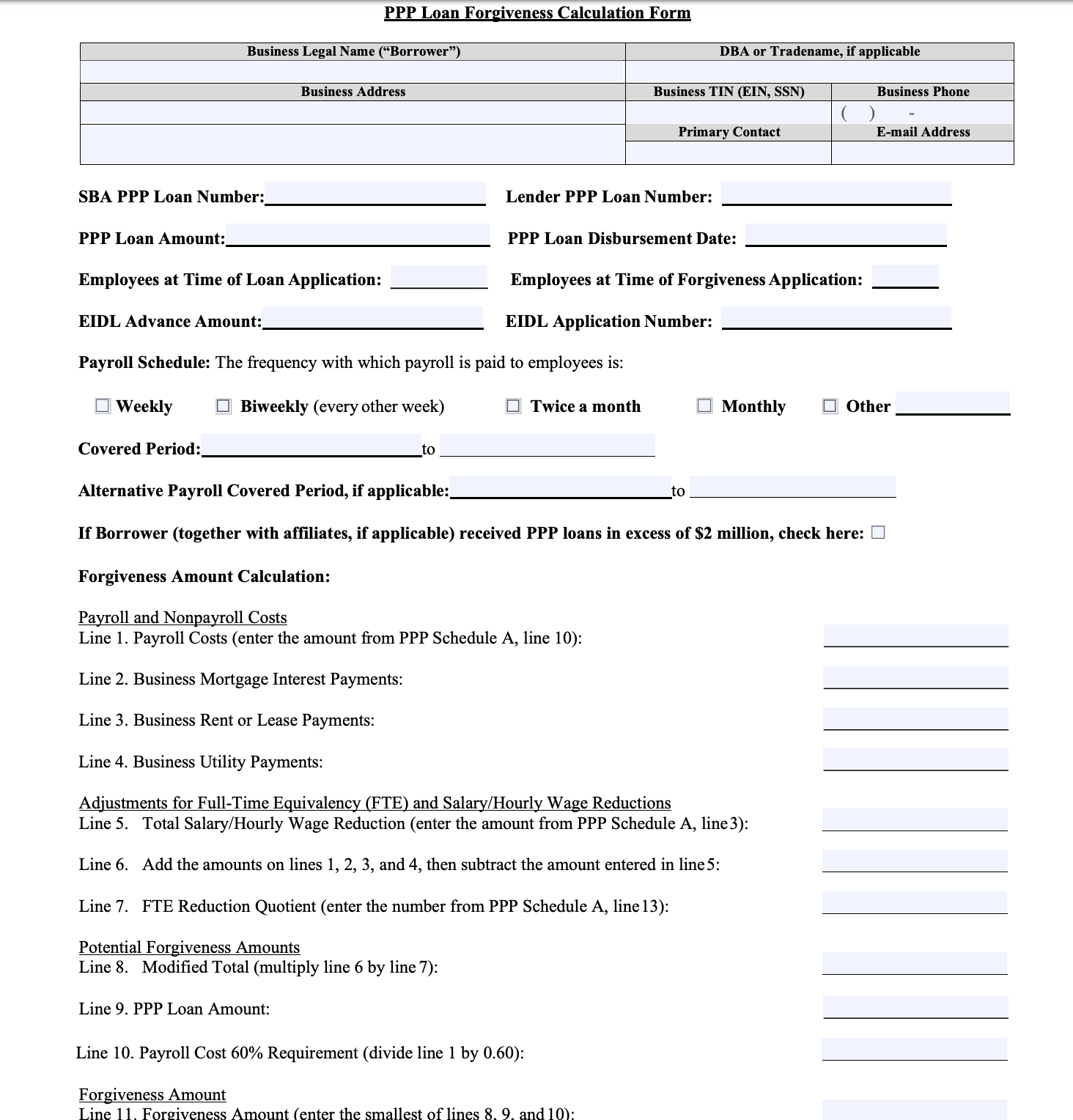

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Accounting For Ppp Loan Forgiveness Cerini Associates Llp Blogs

Pin On Small Business News Workshop

Paycheck Protection Program Ppp Loan Forgiveness Solution

Sba Clarifies Filing Date S For Ppp Loan Forgiveness Gyf

Solved How To Record Ppp Loan Forgiveness

Ppp Loan Forgiveness How To Calculate Wage Reduction Template Included Youtube

How To Record Ppp Loan Forgiveness In Quickbooks Online Youtube

How To Fill Out Your Ppp Forgiveness Application Form Simplifi Payroll And Hr

Does The Timing Of My Ppp Loan Forgiveness Matter

Ppp Loan Forgiveness Application How To Track Ppp Loan Expenses New Template 8 24 20 Youtube

Pay Protection Loan Expenses Business Finance Loan Forgiveness Protection

Pin On Freedom Lifestyle Marketing

Ppp Loan Forgiveness And Business Owner Retirement Contributions Greenspring Advisors

Posting Komentar untuk "How To Record Ppp Loan Forgiveness"