How To Record Ppp Loan Forgiveness On Financial Statements

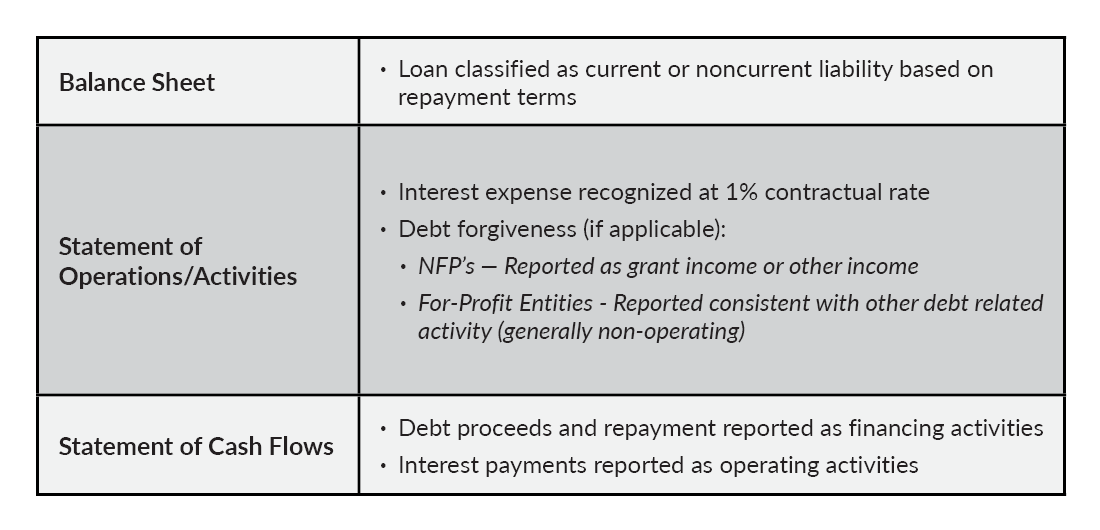

For PPP loans accounted for as a grant ASC 958-605 or IAS 20 The receipt of formal notification of SBA forgiveness will generally have no impact on an organizations financial reporting. Under this option entities record the loan as a liability on the balance sheet and interest is recorded as it would be with any other financing arrangement.

Browse Our Sample Of Employee Payroll Record Template For Free Payroll Template Record Template Payroll

On June 10 the American Institute of Certified Public Accountants AICPA published a technical QA on PPP loan forgiveness providing non-authoritative input guiding nonprofit entities and public and private companies to record the funds as a debt instrument on a.

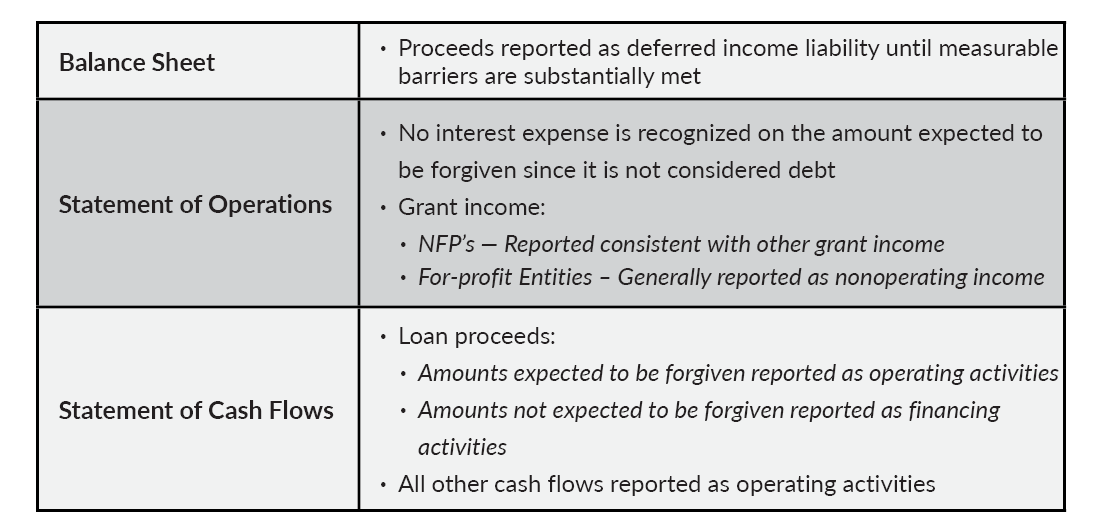

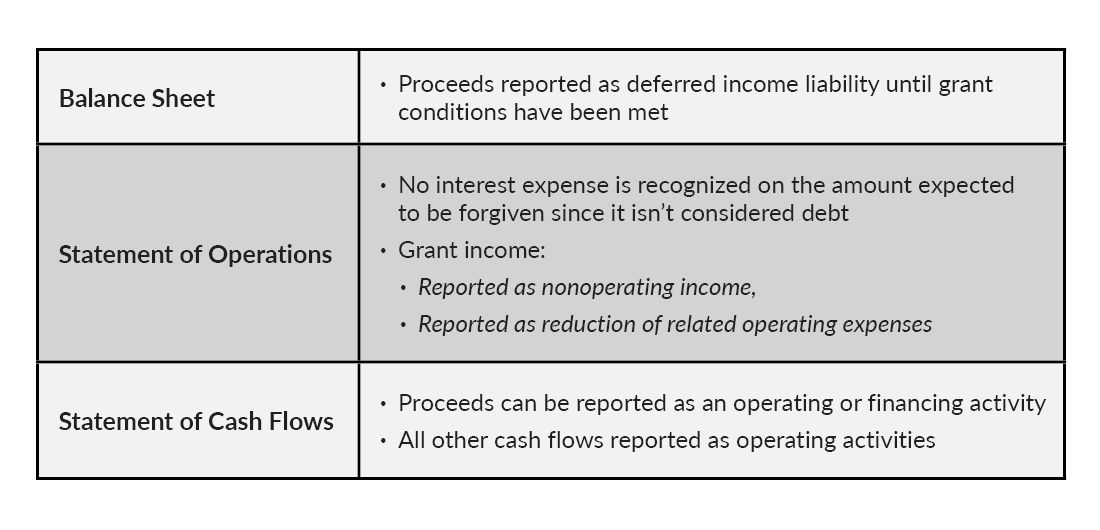

How to record ppp loan forgiveness on financial statements. Recognize the liability and accrue interest over the term of the loan. Its up to recipients of a PPP loan whether forgiven or not to account for it properly. A business entity can also analogize to the guidance in ASC Subtopic 958-605 or ASC Subtopic 450-30.

However there may be diversity in practice regarding how entities treat contractual interest on PPP loans for income tax purposes. Heres a little video to show you what it looks like in Quickbooks Online. Within the income statement this income is presented as a separate line item in the other income and expense section.

The remaining loan balance of Amount of Loan after Forgiveness bears interest at a rate of 1 and is payable in monthly installments of principal and interest over 24 months beginning 6 months from the date of the note as follows. Recording PPP Loan Forgiveness Last Post RSS Katherine katherine-11 Joined. The question becomes during these unprecedented times.

The PPP loan proceeds would be recorded as a liability like any other bank debt and interest would also be recorded. Both approaches are likely acceptable to the extent that the PPP loan forgiveness. An NFP should account for such PPP loans in accordance with ASC Subtopic 958-605 as a conditional contribution.

Topic starter 25112020 956 pm What is the best way to record the forgiveness of a PPP loan. GAAP does not provide specific guidance for PPP loans there are a couple of options available for reporting the PPP loan on financial statements. GAAP on how to account for this.

GAAP does not specifically state how government grants not in the form of a tax credit should be reported in the financial statements. Accounting policy disclosure should include the accounting method followed to record the original loan and to recognize the loan forgiveness. To record PPP loan forgiveness the following entries would be required.

If you do not have an issued financial statement prepared under Generally. The amount of the loan forgiven and amount that was not forgiven and will be repaid. The TQA addresses accounting.

However the American Institute of CPAs AICPA working with its members and Financial Accounting Standards Board FASB staff developed Technical Questions and Answers TQA 320018. While there isnt specific guidance under US. Generally Accepted Accounting Principles GAAP that addresses accounting for PPP loan forgiveness.

And therefore the proceeds should be shown as a financing activity. Any amount forgiven is recorded as gain from extinguishmentforgiveness of debt once legally released from the obligation. Quote Casey casey-4 Joined.

PPP funds 25000 and PPP Loan forgiveness -25000. Loan forgiveness and COVID-19 appear to meet the infrequent and unusual criteria. An entity could follow this treatment for PPP loans when there is more than remote likelihood that the loan.

After the company has applied for loan forgiveness and has been legally released from the debt the company will record. Many entities believe the purpose of PPP loans is for operating expenses and as such proceeds should be recorded as an operating inflow. First create an Other Income account in your chart of accounts called PPP Loan Forgiveness.

If some or all of the loan is forgiven you would record income when legally released from the liability. Unfortunately as with so much of the PPP loan program. There is no specific standard to date from US.

Account for PPP loan as debt. Many businesses have begun applying for forgiveness of their Paycheck Protection Program PPP loans and Q4 of this year is when they will also need to decide how they will report the funds on their financial statements. Interest would be accrued and recorded based on the stated rate in the loan agreement.

Any book-to-tax differences should be accounted for as a temporary difference in the financial statements and should then be reversed when the forgiveness of the accrued interest is recorded. For most companies PPP loans will be accounted for as debt instruments. Then go to your check register and write the check.

The loan was 100 forgiven and the entire amount was used for payroll. GL account Debit Credit PPP loan liabilityOther revenue - PPP loan forgivness10000001000000. How is PPP loan forgiveness reported on financial statements.

Description of the PPP loan and amount awarded from the program. Entities must use judgment to determine if PPP loan activity should be recorded through operating or financing activities. Loan forgiveness amount based on that information and support you in the completion of the loan forgiveness application.

Deferred taxes For entities that account for PPP loans as loans under ASC 470 interest is accrued on the loan for financial statement purposes. The income resulting from forgiveness will be measured based on the net carrying value of the PPP loan which should include accrued interest if forgiven and unamortized financing costs relating to the forgivable portion of the loan. This financial reporting section is most applicable for those PPP recipients who have end-of-year compiled reviewed or audited financial statements.

Others believe PPP loans are forgivable loans. 25112020 1147 pm Your original entry should have. The TQA also states that in situations in which the PPPs eligibility and loan forgiveness criteria are expected to be met.

Using guidance from the AICPA TQA320018 a borrower could elect to report the PPP loan as a government grant if the PPP loan meets both 1 the eligibility requirements for a PPP loan and 2 meets the PPP loan forgiveness criteria for all or. Once the entity is legally released as the primary obligor from the creditor the liability would be derecognized and a gain on PPP loan extinguishment would be recorded. If accounting for the PPP Loan and forgiveness following US GAAP guidance for debt ASC 470.

Loan forgiveness is reflected in capital gains in the accompanying statement of income.

Reid Hoffman And Chris Yeh Share Four Ways To Blitzscale Your Business Https Www Mckinsey Com About Architecture Photo Modern Architecture Spiral Stairs

Best Short Term Business Loans Top Picks For 2021 Business Loans Small Business Loans Business

Paycheck Protection Program Loans Accounting What Are The Options Explore Our Thinking Plante Moran

How To Account For And Record Ppp Forgiveness Blue Co Llc

Paycheck Protection Program Loans Accounting What Are The Options Explore Our Thinking Plante Moran

10 Financial Reporting Reminders For Ppp Borrowers Crowe Llp

S Corp Google Search Sole Proprietorship Business Tax S Corporation

Excel Payroll Calculator Template Software Download Payroll Template Payroll Excel Spreadsheets Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

3 Approaches For Reporting Ppp Forgiveness On Financial Statements

Paycheck Protection Program Loans Accounting What Are The Options Explore Our Thinking Plante Moran

Financial Statement Impact Of Ppp Loan Kyj Llp

Solved How To Record Ppp Loan Forgiveness

Business Structure Tax Comparison Where Can You Save Money Small Business Trends Business Structure Small Business Trends Business Tax

Posting Komentar untuk "How To Record Ppp Loan Forgiveness On Financial Statements"