How To Document Ppp Loan Forgiveness For Sole Proprietorship

If you report your business income and expenses on Schedule C of your Form 1040 your PPP loan forgiveness is straightforward as you see in the four answers below. Documents to Include with Your PPP Loan Forgiveness Application Form.

Using the OCR sole proprietors can claim forgiveness based upon 2019 net profit.

How to document ppp loan forgiveness for sole proprietorship. In essence the PPP loan should be roughly ten weeks worth of 2019 net profit. Using the OCR sole proprietors can claim forgiveness based upon 2019 net profit. The applicable interim final rule states that the amount eligible for forgiveness shall include owner compensation replacement calculated based on 2019 net profit with forgiveness.

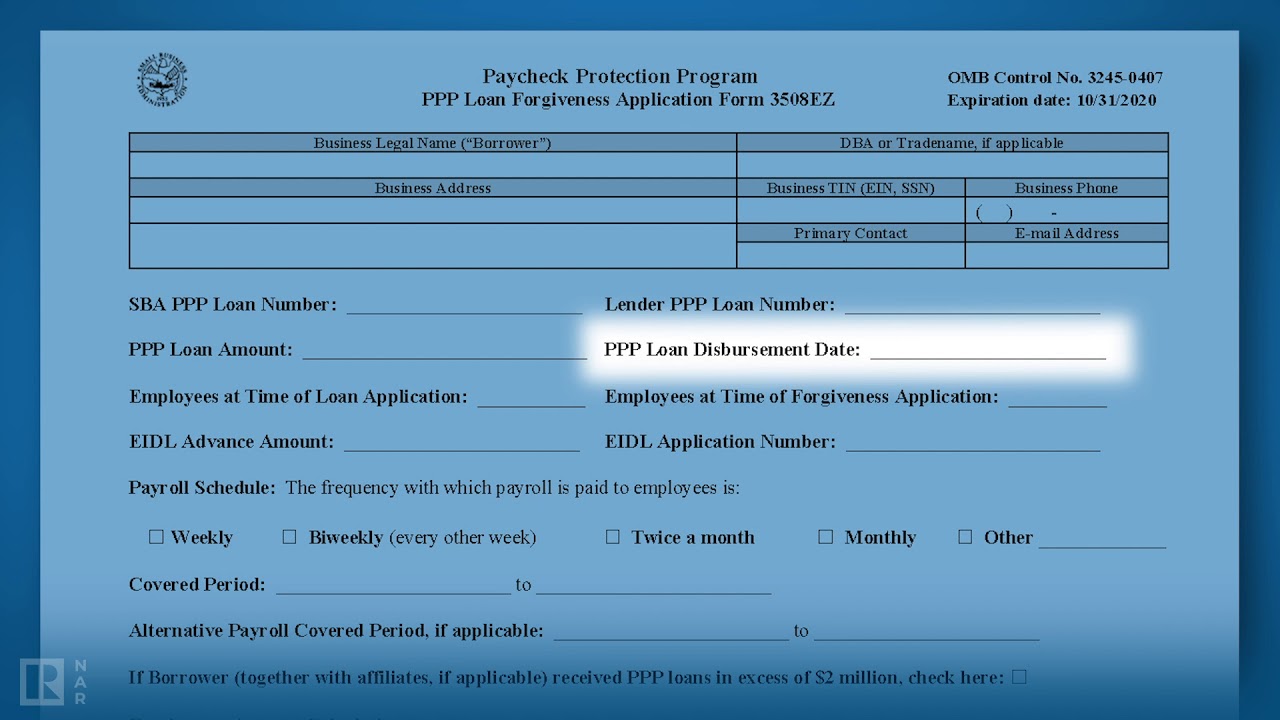

List your PPP loan information. Fortunately you do not need to show your calculations for the amount you are requesting because it is a fairly straightforward analysis based upon your loan amount. You need to verify your eligible payroll and any non-cash benefit payments during the covered period 8 or 24 weeks.

The blog will help you calculate owner replacement compensation or the amount that you paid yourself. If you have employees. Youll need to submit this application within 10 months of the end of your covered periodif not your loan payment deferment will end and youll have to start.

Loan number loan amount lender disbursement date etc. Sole proprietors will still need to prove expenses to receive forgiveness. To get approved for PPP loan forgiveness you will need to show that youve maintained the same number of employees as before during the time you utilized your loan.

How to Apply for PPP Loan Forgiveness as a Self-Employed Worker. You got your PPP sole proprietor loan. Take your reported net income in 2019 on your Schedule C and multiply that by 852 or 0154.

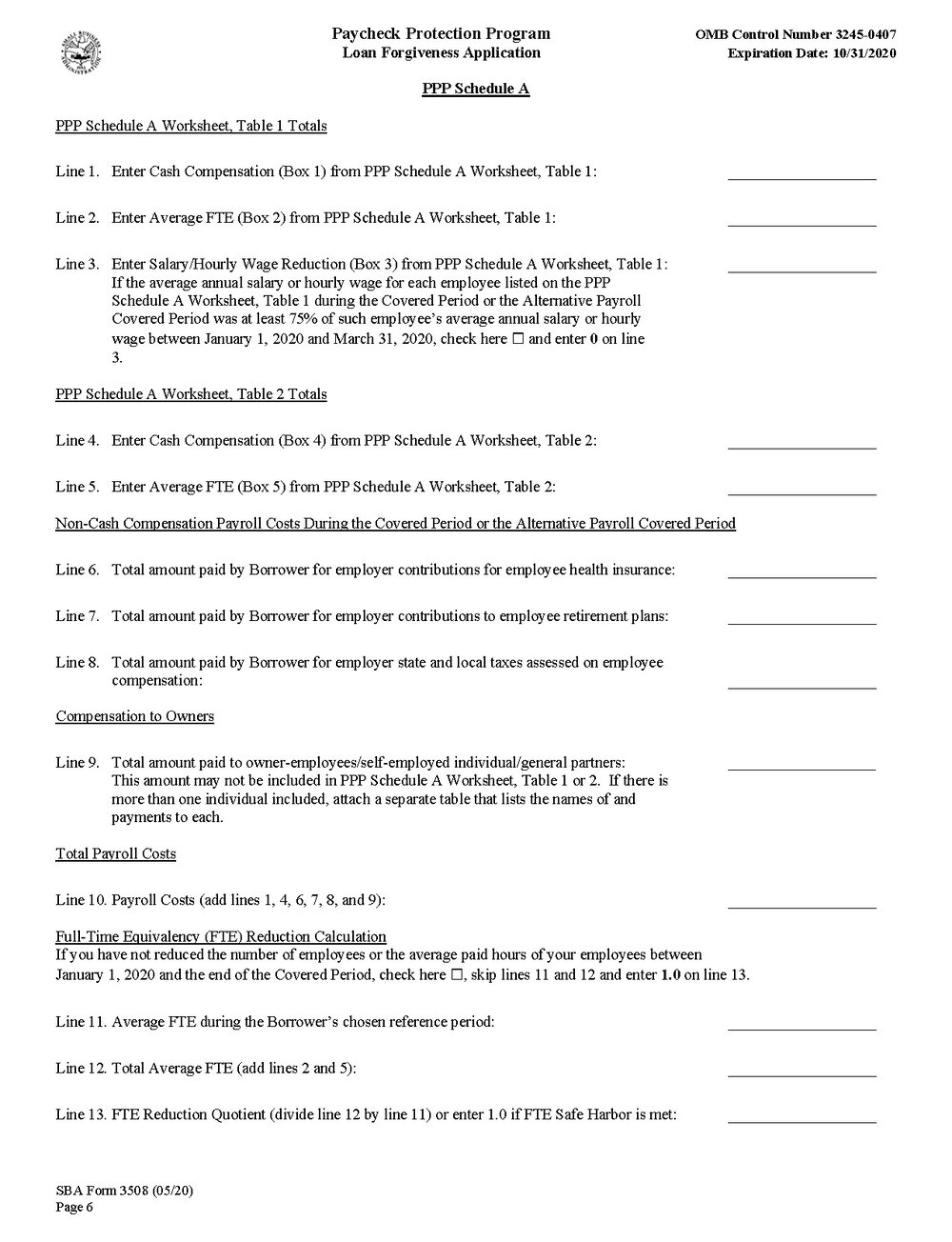

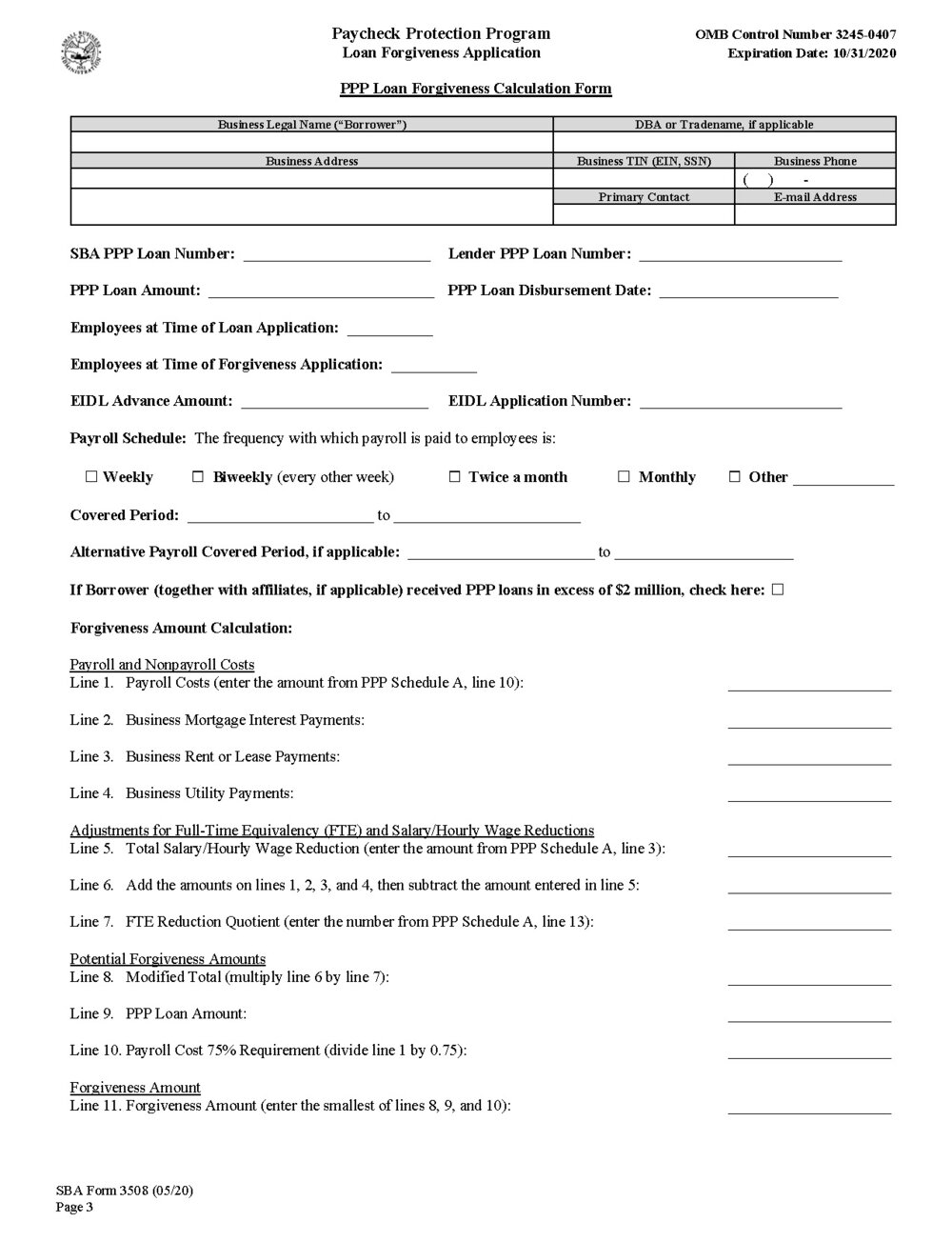

How to fill out the PPP loan forgiveness application forms. You got your PPP sole proprietor loan. There are two main sections to PPP forgiveness forms.

This is a blog on how to apply for Program Protection Program PPP loan forgiveness Form 3508S for self-employed individuals with no employees. Drivers License Photo ID. Youll work with your lender on your PPP loan forgiveness application.

Your bank might consider forgiveness if you comply with SBA Guidelines. Borrowers who received loans prior to June 5 2020 may elect to use the 8-week forgiveness covered period and can claim eight weeks worth of OCR. Borrower certification required by Section 1106e3 of the Act.

Youre not done yet. Youll need to apply for forgiveness within 10 months of the last day of your covered loan period to be eligible for loan forgiveness. Accounting Tax Assurance 610-558-3337.

What documents will you need to request a loan forgiveness. SPs with payroll must have all those documents as well as payroll reports relating to the weeks of payroll. However they are the ones looking into the nitty gritty details to prove to the SBA that you had followed all the rules.

The amount of owner compensation replacement eligible for you to claim for forgiveness is calculated as follows. Before you can submit your completed 3508S or 3508EZ form there are a few documents youll need to include. To apply for loan forgiveness you should contact your PPP lender and complete the correct application form.

Your forgiveness amount request and calculations if applicable Business and loan information. It is not necessary to document any payroll. If you had to lay off employees it wont necessarily mean that your business will be found ineligible.

The SBA has not yet published its official guidance regarding PPP loan forgiveness. State quarterly wage unemployment insurance tax forms or equivalent payroll processor records. It will be one of the following.

They should have sent you follow-up information on how to submit your forms and paperwork. Often the amount you seek to be forgiven. Borrowers who received loans prior to.

Your bank might consider forgiveness if you comply with SBA Guidelines. Your business and loan information. How to complete Form 3508S for Self-Employed Individuals with no Employees.

To support the forgiveness claim SPs without payroll must provide a 2019 1099-MISC or Schedule C form the rentallease or mortgage statement and utilities statements. To streamline the application process and ensure youre able to complete the full application using our automated platform please check out which documents you should have ready as a Sole Proprietorship or Self Employed business with Employees. It is not necessary to document any payroll.

List your requested loan forgiveness amount. For all PPP forgiveness forms you will be required to provide the following information regarding your business and loan. However it is important to note that currently only a portion of the sole proprietors owner compensation replacement is forgivable.

By Bill Cunningham. In those circumstances because PPP income is capped at 100000 the maximum amount allowed as OCR.

Know About Ppp Loan Forgiveness For Loans Of 50 000 Or Less

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Everything You Should Know About Ppp Loan Forgiveness Stratlign Your Expert Accounting Connection

Ppp Loan Forgiveness Ppp Loan Form 3508s Self Employed Sole Proprietors Independent Contractors Youtube

How To Complete The Ppp Loan Forgiveness Application Form 3508ez Youtube

When Can I Submit My Ppp Loan Forgiveness Application Bench Accounting

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness For Sole Proprietor And Self Employed Youtube

Covid 19 Response Ppp Forgiveness Applications And A Sole Proprietor Application Example

How To Track Ppp Loan Expenses For Sole Proprietors Independent Contractors Template Included Youtube

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application Step By Step Guide To Get 100 Ppp Loan Forgiveness Youtube

Ppp Loan Forgiveness Step By Step How To Fill Out The Ppp Loan Forgiveness Application 3508ez Youtube

Posting Komentar untuk "How To Document Ppp Loan Forgiveness For Sole Proprietorship"