Can I Deduct My Home Office Expenses In 2020

If the office measures 150 square feet for example then the deduction would be 750 150 x 5. This write-off covers office supplies postage computers printers and all.

Your Guide To Tax Deductions For 2020 N26

The act now prevents full-time W-2 employees from deducting home office expenses on their 2020 taxes even when they worked from home more than they did in the.

Can i deduct my home office expenses in 2020. The utilities expense for the year were 4000. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return. The number of people who work from home exploded in 2020 because of the COVID-19 pandemic.

Self-employed people can deduct office expenses on Schedule C Form 1040 whether they work from home or not. HR Block As America tries to contain the spread of COVID-19 businesses have made tough decisions to stay afloat and maintain a healthy work environment for employees. The number of people who work from home exploded in 2020 because of the COVID-19 pandemic.

Under the Tax Cuts and Jobs Act TCJA employees working remotely can no longer deduct home office expenses on their tax returns to the extent they exceeded 2 of adjusted gross income AGI. Home office deductions for independent contractors and the self-employed You can claim home office deductions on your 2020 tax returns if you are self-employed or an independent contractor and you. If you want to repair a certain portion of your house that includes your home office you have to deduct a certain amount from the tax that covers your home business.

Seven in 10 people who can. Track your total home expenses These are not expenses that go into your. For 2020 the prescribed rate is 5 per square foot with a maximum of 300 square feet.

How Working from Home in 2020 Affects Income Taxes. 7 days ago Feb 01 2013 There have been no special federal tax breaks related to working from home because of the COVID-19 pandemic either for those employed by someone else or the self-employed. The space must still be dedicated to business activities.

Most employed Californians simply take the standard deduction whether filing single or as a married couple. No work-at-home deduction is being discussed as part of the relief bill thats stalled in Congress. If you are using Temporary flat rate method you do not need to determine your expenses to calculate your claim for home office expenses in 2020.

Some people will be able to take a tax deduction for their home office expenses but. Its understandable why taxpayers readying their 2020 returns might be eyeing the home office deduction which provides tax breaks for people who do their work from home. You can deduct the costs of a home office if you are filing a Schedule C.

On the contrary if you repair something within the home office boundaries you are eligible for a 100 tax deduction. 2020 Tax Year 150000 is paid for the home in 2010 and 10 of it is used for a home office in 2020 for 9 months. With either method the qualification for the home office deduction is determined each year.

Broach said you still want to keep track. The short answer is probably not. The home office portion is 300 3000 x 10.

9 months of that amount is 3000. Qualifying for a home office tax deduction during the coronavirus crisis April 10 2020. Some people will be able to take a tax deduction for their home office expenses but many will not.

You can take 10 of your total home expenses for the year as a home office deduction Step 2.

Home Office Deduction Worksheet Excel

Tax Deductions In Germany 10 Deductible Expenses At A Glance Penta

What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

Home Office During The Corona Pandemic

Home Office Deduction Pointers For Federal Taxes Credit Karma

How Does Working From Home Change Tax Deductions In 2020

Working From Home Tax Deductions Covid 19

Tricks To Help You Save Money On Taxes If You Worked From Home In 2020

Guide To Understanding Home Office Deductions Flexjobs

Home Office Tax Deduction In 2021 New Updates Taxact

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Work From Home Tax Deduction Only Applies To Self Employed Workers

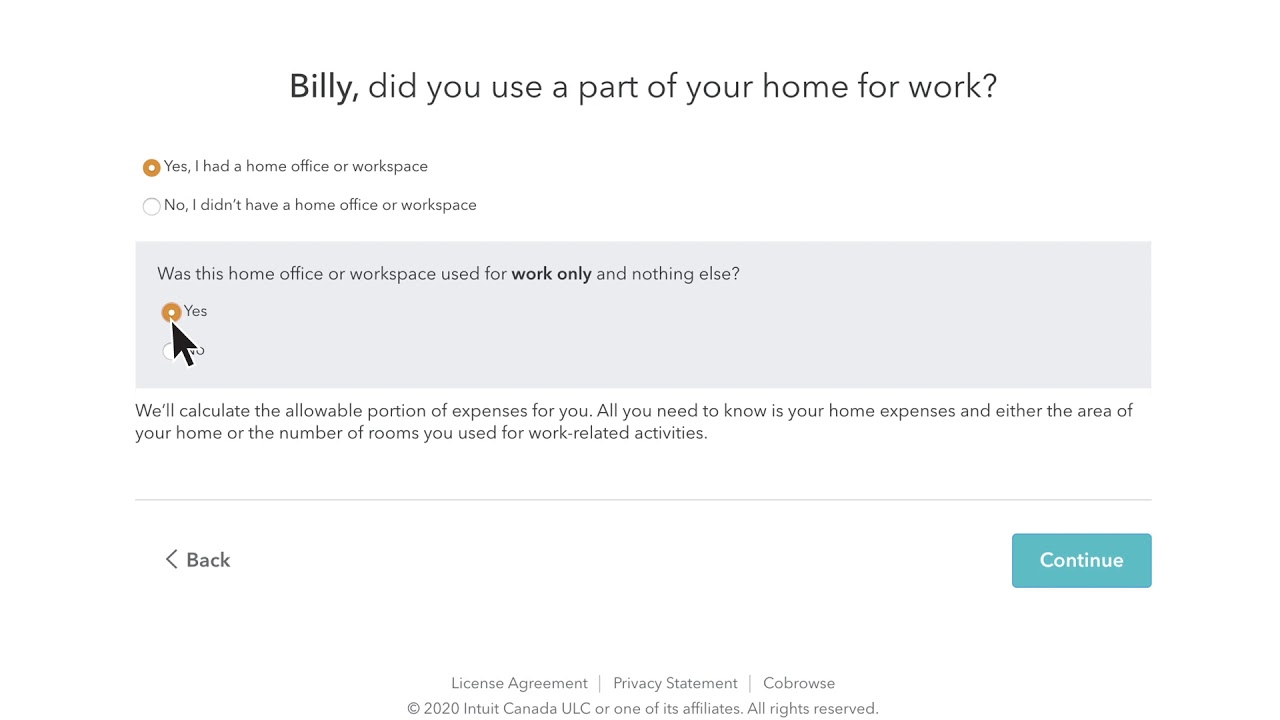

Quiz Do I Qualify For The Home Office Deduction

Work From Home Tax Deduction Only Applies To Self Employed Workers

Home Office Expenses Are You Missing Out On Tax Deductions

Deducting Home Office Expenses As An Employee In 2020 Wolters Kluwer

Posting Komentar untuk "Can I Deduct My Home Office Expenses In 2020"