Can I Deduct Home Office Expenses In 2020

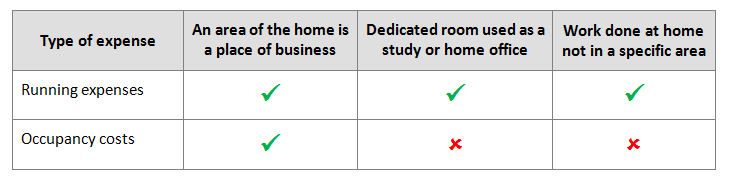

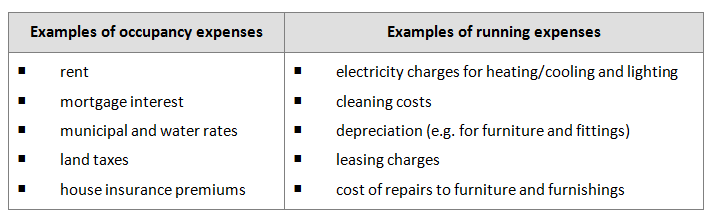

If for example your home office is 20 square metres and your house is 200 square metres then you can deduct 10 of the qualifying expenses such as rates and taxes or interest payable on bonds. If you file Schedule C Form 1040 to report your business income use IRS Form 8829-Expenses for Business Use of Your Home to deduct your actual home office expenses.

How To Deduct Your Home Office On Your Taxes Forbes Advisor

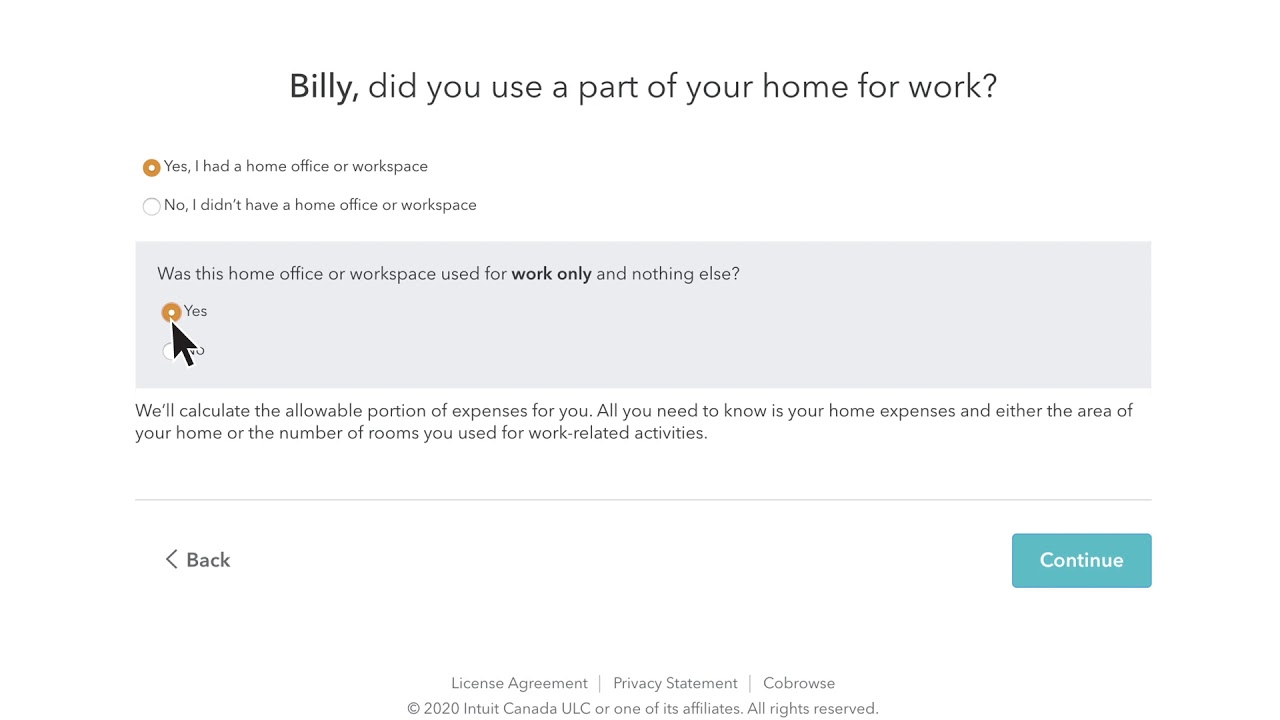

Fill in the form Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day.

Can i deduct home office expenses in 2020. Using this method you can claim 80 cents per hour for each hour you work from home. The temporary flat-rate method and the detailed method. Between 1 March to 30 June 2020 in the 201920 income year for the 202021 income year.

9 months of that amount is 3000. The utilities expense for the year were 4000. Employment and is specifically equipped for that purpose.

You cant deduct all your expenses. Maybe you bought some supplies a new desk or a chair or youre just paying more for a better Internet connection. You can also claim for stationery and data costs.

If youre self-employed you can enter the deduction for your home office expenses in the appropriate section in the self-assessment form online or on paper. Using either method you must complete the new Form T777S Statement of Employment Expenses for Working at Home Due to COVID-19 and you must include the completed copy with your 2020 tax return. The number of people who work from home exploded in 2020 because of the COVID-19 pandemic.

Some people will be able to take a tax deduction for their home office expenses but many will. Wear and tear on office equipment. For 2020 the prescribed rate is 5 per square foot with a maximum of 300 square feet.

2020 Tax Year 150000 is paid for the home in 2010 and 10 of it is used for a home office in 2020 for 9 months. With either method the qualification for the home office deduction is determined each year. Or you might choose to use the simplified method for home office deductions which is based on the square footage of.

This amount will be your claim for 2020 up to a maximum of 400 per individual. If the room is regularly and exclusively used for the purposes of the taxpayers trade eg. If the office measures 150 square feet for example then the deduction would be 750 150 x 5.

Its understandable why taxpayers readying their 2020 returns might be eyeing the home office deduction which provides tax breaks for people who. Section 23 b of the Income Tax Act states that a tax deduction for home office expenses is only allowed. The home office portion is 300 3000 x 10.

You cannot claim expenses or allowances for buying building premises. Calculation of deduction Under the temporary flat rate method the home office expense deduction is calculated as 2 per day for each day the eligible employee worked from home in 2020 due to COVID-19 up to a maximum of 400. You must meet the eligibility criteria - Temporary flat rate method to claim your home office expenses.

If so you may be wondering if youre allowed to take the home office tax. The act now prevents full-time W-2 employees from deducting home office expenses on their 2020 taxes even when they worked from home more than they did in the. The home office must be set up solely for the purpose of working.

Claim expenses for repairs and maintenance of business premises and equipment. The CRA is permitting two temporary methods of deducting home office expenses in 2020. You can claim tax relief on your office at home using the self-assessment tax return forms.

For alterations to install or replace equipment. You can either provide the total expenses or list a detailed break-down of expenses. Temporary flat rate method If you are using Temporary flat rate method you do not need to determine your expenses to calculate your claim for home office expenses in 2020.

The space must still be dedicated to business activities. This method is temporary and can only be used to work out your work from home deduction.

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Claiming Expenses For Working From Home During Covid 19 Taxbanter

Claiming Expenses For Working From Home During Covid 19 Taxbanter

How Does Working From Home Change Tax Deductions In 2020

Work From Home Tax Deduction Only Applies To Self Employed Workers

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Home Office During The Corona Pandemic

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Home Office Expenses Are You Missing Out On Tax Deductions

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Home Office Deduction Pointers For Federal Taxes Credit Karma

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Working From Home Tax Deductions Covid 19

Work From Home Tax Deduction Only Applies To Self Employed Workers

Home Office Tax Deduction In 2021 New Updates Taxact

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Working From Home Tax Deductions Covid 19

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Posting Komentar untuk "Can I Deduct Home Office Expenses In 2020"